Social Security’s Cost of Living Adjustment (COLA) for 2025 is projected to be 2.8%, offering retirees a boost in their benefits to help offset rising living expenses, though the exact impact will depend on individual circumstances and inflation trends.

Get ready for a potential boost in your Social Security benefits! The projected Breaking: Social Security COLA Increase Projected at 2.8% for 2025 – What It Means for Retirees could offer some financial relief in the face of ongoing inflation, but what does this really mean for your bottom line?

Understanding the Social Security COLA

The Social Security Cost of Living Adjustment, or COLA, is a crucial mechanism designed to protect the purchasing power of Social Security benefits. It adjusts payments annually to reflect changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), ensuring that beneficiaries can keep up with rising costs.

How COLA is Calculated

The COLA is primarily based on the CPI-W, which measures the average change over time in the prices paid by urban wage earners and clerical workers for a basket of goods and services. The Social Security Administration (SSA) uses the average CPI-W from July, August, and September of the current year and compares it to the average from the same period in the previous year.

Why COLA Matters

Without COLA, the real value of Social Security benefits would erode over time due to inflation. This adjustment helps maintain a stable standard of living for retirees, disabled individuals, and other beneficiaries who rely on these payments for essential expenses.

In summary, understanding the Social Security COLA is essential for beneficiaries to appreciate how their benefits are adjusted to keep pace with the cost of living, ensuring financial stability in the face of economic changes.

The Projected 2.8% COLA Increase for 2025

For 2025, the Social Security COLA is currently projected to be 2.8%. This estimate is based on the latest inflation data and forecasts. While this is just a projection and could change, it provides an early indication of what beneficiaries might expect.

Factors Influencing the Projection

Several economic factors influence the COLA projection. Inflation trends, energy prices, and overall economic growth all play a role. Monitoring these indicators can provide clues about the direction of future COLA adjustments.

Historical COLA Rates

Looking back at historical COLA rates can provide context. In recent years, COLA adjustments have varied significantly, reflecting different economic conditions. Understanding these past adjustments helps in appreciating the current projection.

- 2022: 5.9%

- 2023: 8.7%

- 2024: 3.2%

In conclusion, the projected 2.8% COLA increase for 2025 is influenced by various economic factors and provides an early estimate of potential benefit adjustments, highlighting the importance of monitoring economic trends.

Impact on Social Security Benefits

A 2.8% COLA increase will directly impact the amount of Social Security benefits that beneficiaries receive. This adjustment can provide a much-needed boost to monthly payments, helping to address rising expenses.

Estimating Your Benefit Increase

To estimate your potential benefit increase, simply multiply your current monthly benefit amount by 0.028. For example, if you currently receive $1,500 per month, a 2.8% increase would add $42 to your monthly payment.

Changes to Medicare Premiums

It’s important to note that changes to Medicare premiums can affect the net increase in Social Security benefits. Medicare Part B premiums are often deducted directly from Social Security payments, so an increase in premiums can offset some of the COLA adjustment.

In summary, while a 2.8% COLA increase can boost Social Security benefits, the net impact can be influenced by factors such as Medicare premium adjustments, making it essential to consider the complete financial picture.

How Retirees Can Prepare

Retirees can take several steps to prepare for the upcoming COLA increase and ensure they are making the most of their Social Security benefits. Planning and budgeting are key to managing finances effectively.

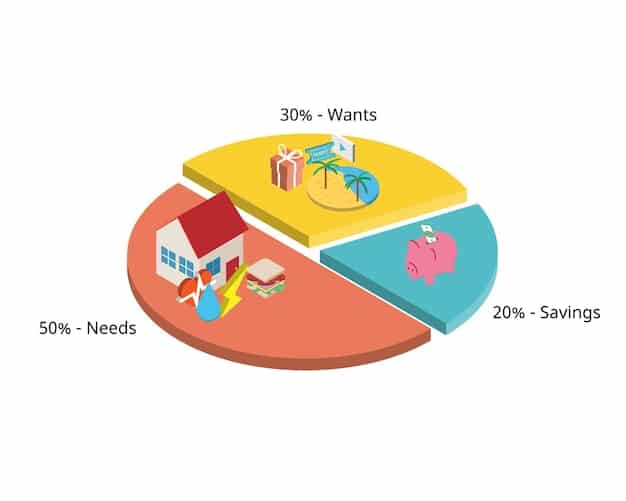

Reviewing Your Budget

Start by reviewing your current budget to identify areas where you may need additional funds. Consider essential expenses such as housing, healthcare, food, and transportation. Adjust your budget to reflect any anticipated changes in costs.

Planning for Healthcare Costs

Healthcare costs often represent a significant portion of retirees’ expenses. Investigate options for managing these costs, such as supplemental insurance plans or cost-saving strategies. Be prepared for potential increases in Medicare premiums.

Seeking Financial Advice

Consider consulting with a financial advisor to get personalized advice on managing your retirement income. A financial advisor can help you create a comprehensive financial plan that takes into account your individual circumstances and goals.

In conclusion, retirees can prepare for the 2025 COLA increase by reviewing their budget, planning for healthcare costs, and seeking financial advice to ensure they are managing their benefits effectively.

Understanding the Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a vital economic indicator used to measure changes in the average prices paid by urban consumers for a basket of consumer goods and services. It helps track inflation, which is the rate at which the general level of prices for goods and services is rising, and therefore the purchasing power of currency is falling.

CPI vs. CPI-W

It’s essential to distinguish between the CPI and the CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers). While both indices measure inflation, they focus on different groups of consumers. The CPI covers all urban consumers, while the CPI-W specifically targets wage earners and clerical workers. Social Security COLA adjustments are based on the CPI-W.

How the CPI is Used

The CPI is used for various purposes, including adjusting Social Security benefits, federal payments, and private contracts. It serves as a benchmark for economic policy and helps policymakers make decisions about monetary and fiscal strategies.

Long-Term Outlook for Social Security

The long-term outlook for Social Security is a topic of ongoing discussion and concern. Demographic trends, such as an aging population and longer life expectancies, are putting pressure on the system’s financial sustainability. Understanding these challenges is crucial for future retirees.

Potential Reforms

Various reforms have been proposed to address the long-term challenges facing Social Security. These include measures to increase revenue, such as raising the retirement age, increasing the Social Security tax rate, or adjusting the benefit formula.

The Role of Congressional Action

Ultimately, the future of Social Security depends on congressional action. Policymakers will need to find ways to ensure the system’s solvency while protecting the benefits of current and future retirees.

- Raising the Retirement Age: Gradually increasing the age at which individuals can claim full retirement benefits.

- Increasing the Tax Rate: Raising the Social Security tax rate paid by workers and employers.

- Adjusting the Benefit Formula: Modifying the formula used to calculate initial Social Security benefits.

In conclusion, the long-term outlook for Social Security requires careful consideration of demographic trends, potential reforms, and the role of congressional action to ensure the system’s sustainability.

| Key Point | Brief Description |

|---|---|

| 💰 COLA Increase | Projected 2.8% increase in Social Security benefits for 2025. |

| 📈 CPI-W | COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers. |

| ⚕️ Medicare Premiums | Changes can affect the net increase in Social Security benefits. |

| 📊 Budget Review | Essential to manage finances effectively with the COLA increase. |

Frequently Asked Questions (FAQ)

▼

The Social Security Cost of Living Adjustment (COLA) is an annual adjustment to Social Security benefits to help offset the effects of inflation, ensuring retirees maintain their purchasing power.

▼

The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), comparing averages from July, August, and September of the current and previous years.

▼

If the 2.8% projection holds, your monthly benefit will increase by approximately 2.8%. Multiply your current benefit amount by 0.028 to estimate the increase.

▼

Yes, Medicare Part B premiums are often deducted from Social Security payments, so an increase in premiums can offset some of the COLA increase.

▼

Review your budget, plan for healthcare costs, and consider seeking financial advice to ensure that you are managing your benefits effectively and making informed financial decisions.

Conclusion

In conclusion, the projected 2.8% Breaking: Social Security COLA Increase Projected at 2.8% for 2025 – What It Means for Retirees offers a potential increase in benefits for retirees, helping to offset rising living expenses. Understanding the factors influencing this adjustment and planning accordingly can help ensure financial stability in the coming year.